How growing old can shrink national economic growth

Increase in Asian elderly population © Shutterstock, Inc.

Many Asian countries are currently facing the challenge of a rapidly aging population. Although these demographic changes can be taken as positive indicators of the high quality of life in this region, aging populations can also have adverse effects on average income. This negative correlation between aging and economic growth can in part be attributed to both a reduced workforce and an increased dependence on social security. Keisuke Otsu, now at Keio University, worked with Katsuyuki Shibayama of the University of Kent to study the underlying factors at the root of this complex relationship between aging and economic growth.

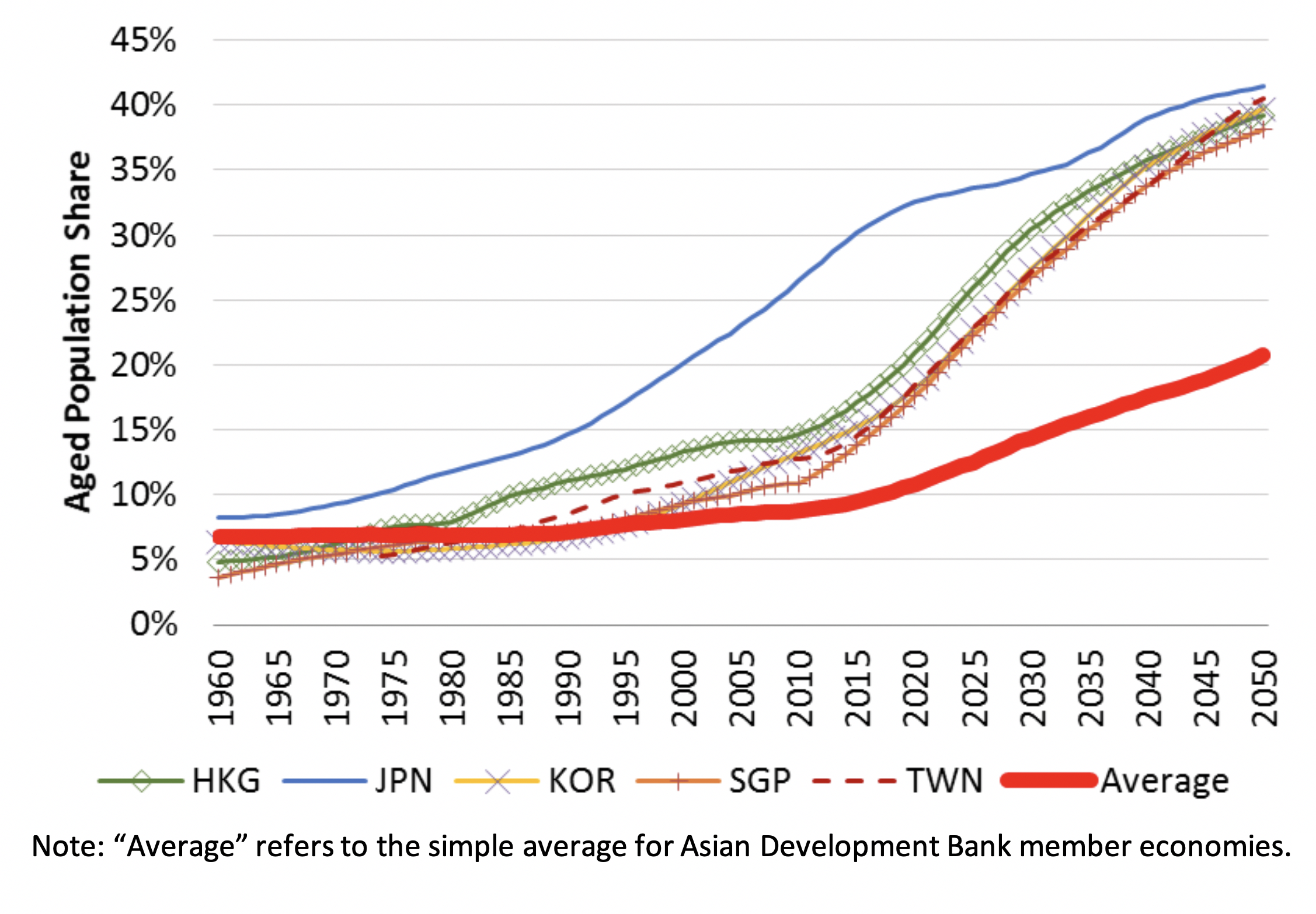

The researchers analyzed projections for two demographic groups in Asian countries including Japan, China, and South Korea: 15─64 year-olds and those 65 years or older, for the period between 2015─2050. It has been predicted these countries will undergo a decline in the rate of population growth, and by 2050, 40% of people living in these countries will be over 65 years of age. To explore further, they developed a model that quantified the impact of aging populations on economic activities. The model consists of four economic agents that contribute to the state of the economy: young members of households who comprise the workforce; older members of households who are retired; companies that employ individuals from these households; and finally the government. The contributions of each of these groups to the economy were then projected.

Figure1. Population aging in Asia © Keio University

In the model, population aging first adversely affects economic growth as it directly reduces the size of the workforce. Population aging also increases social security payments which has to be financed through increased labor income tax, which reduces the incentive of workers to be productive. Moreover, population aging will lead to higher government spending on healthcare services, which on the one hand stimulates the economy through increased aggregate demand, while on the other, reduces resources allocated to productive government activities such as research and development and education. The latter further hinders productivity growth and hence the long-term growth in per capita income.

The researchers then pieced all of these factors together and computed the long-term projections of the effects of aging on key drivers of the economy. They concluded that the entire chain of events could reduce the per capita income growth rate by 0.71 percentage points. Furthermore, the direct effect of population aging on the workforce accounts for 0.21 percentage points, while the associated increase in labor income tax and decline in productivity growth mainly account for the remaining slowdown in economic growth. These findings on the complex relationship between aging societies and economics offer important insights for formulating economic policies for the future.

Published online 27 June 2019

About the researcher

Keisuke Otsu― Professor

Faculty of Business and Commerce

Keisuke Otsu received his PhD from the Department of Economics, UCLA in 2006. He worked at the Institute for Monetary and Economic Studies at the Bank of Japan, the Faculty of Liberal Arts at Sophia University, and the School of Economics at the University of Kent before moving to the Keio University Faculty of Business and Commerce in 2017.

Reference

- Keisuke Otsu and Katsuyuki Shibayama. Population Aging and Potential Growth in Asia. Asian Development Review. 33, 56-73 (2016). | article