The costs firms incur when changing the quality of their products can determine how they fare with respect to their competitors

Published online 28 September 2018

Revenues and costs © Keio University

Expanding into new markets is a key step in the growth of a firm, while understanding which factors give a competitive advantage is strategically important. However, models that predict the positioning of different firms in a new market often fail to capture all of the complex factors that determine the positioning of a particular firm in relation to its competitors. Now, Shogo Kurokawa and Nobuo Matsubayashi from Keio University in Japan have come up with a new theoretical model that accounts for the costs incurred when changing the quality level of products, revealing the significant impact this can have in the final equilibrium outcome.

If, when launching a new product or introducing an existing product to a new market, the said product has the same quality as existing ones, the only costs a firm incurs are those related to its manufacture. Otherwise, there are additional costs related to the 'repositioning' the firm must undergo in order to shift from the quality level of existing products to that of the new one. These costs are higher if the gap in quality is greater, and include new production facilities, know-how, distribution networks, marketing, and advertising costs. Furthermore, repositioning costs remain high even if the quality of the product is lowered (for example, to sell in a market where prices tend to be lower). In such cases, costs are mainly related to maintaining the firm's reputation and avoiding brand dilution.

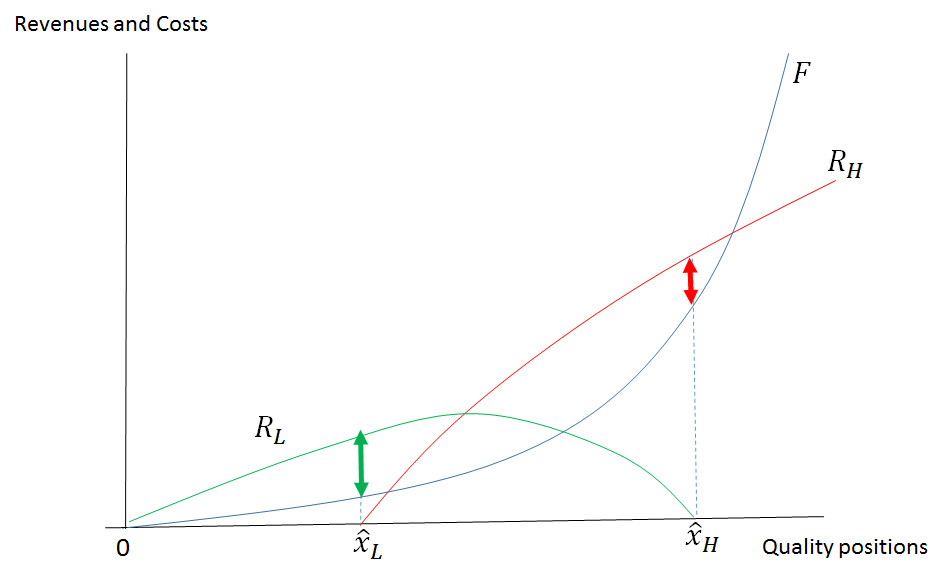

The authors studied a duopoly model of vertical differentiation (that is, their products differ in quality rather than features such as color) which took into account repositioning costs to analyze how they changed the outcome at equilibrium and the relative profitability of the two firms. They examined the case of two established firms that entered a new market and chose a quality level and price. The decisions over quality and price made by the two firms were then modelled and analyzed using game theory.

The study found that repositioning costs reduced the ability of firms to differentiate themselves from each other vertically, resulting in highly-positioned firms being pushed to offer products of excessively high quality, and vice versa. When firms had similar quality positions, the quality levels of their products were sometimes the reverse of their respective quality positions, with the top-level product of the lower-quality firm being better than the bottom-level product of the higher-quality firm. Moreover, the firm with the higher-quality position sometimes generated smaller profits than its rival, even if its products were better. It was found that, in particular, when the repositioning costs differed significantly between the two firms, as in the case of pre-established and new firms, the lower-positioned firm could make higher profits by strategically choosing a lower-quality product.

The authors thus showed that conventional wisdom stemming from standard models claiming that higher-quality positions are always advantageous does not hold true in all situations.

About the researcher

Nobuo Matsubayashi― Professor

Department of Administration Engineering, Faculty of Science and Technology

Nobuo Matsubayashi received his Ph.D. in Industrial Engineering in 2004 from Keio University. From 1996 to 2004 he was an employee of Nippon Telegraph and Telephone Corporation (NTT) and NTT Communications Corporation. From 2004 to 2006, he was a research associate at the Department of Industrial Administration, Tokyo University of Science and joined Keio University in 2006.

His research interests include game-theoretic analysis of competitive marketing strategy (e.g. product positioning, product variety and mass customization), channel coordination in supply chains, and coalition and network formation. He has published articles in academic journals in the areas of operations research/management science and economics.

Links

Reference

- Kurokawa S, Matsubayashi N. Price and quality competition with quality positions. J Econ Manage Strategy. 27:71-81 (2018). | article